![]()

HIGH INCOME PASS-THROUGH SECURITIES INDEX

The EQM High Income Pass-Through Securities Index (HIPSTR) seeks to generate diversified, high income utilizing U.S. exchange-listed high income pass-through securities in the following alternative income asset categories which must return 90% of their taxable income to shareholders: Closed-End Funds (CEFs), Business Development Companies (BDCs), Real Estate Investment Trusts (REITs), and Energy Master Limited Partnerships (MLPs).

The index is reconstituted annually and rebalanced quarterly back to an equal weighted index of 40 high income pass-through securities.

Disclosure: The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of particular time and subject to change at any time without notice.

HIGH INCOME PASS-THROUGH SECURITIES INDEX KEY FACTS

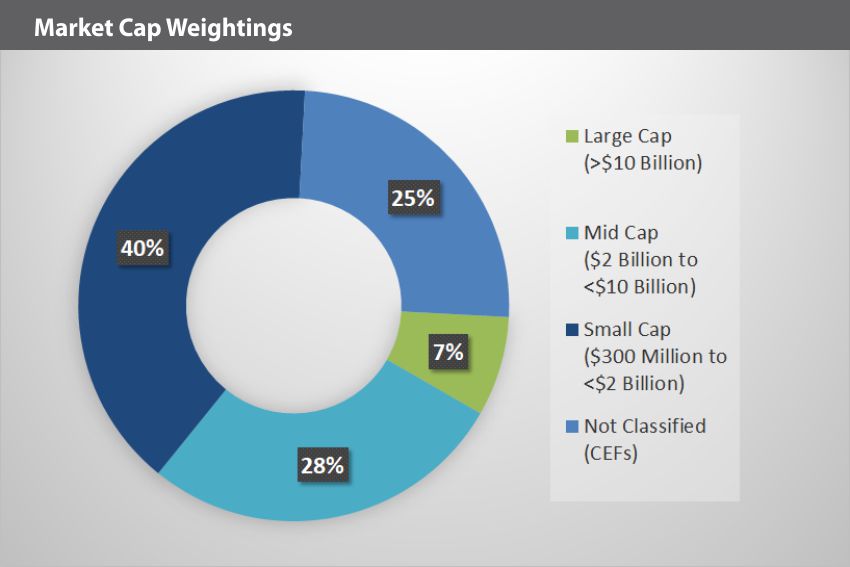

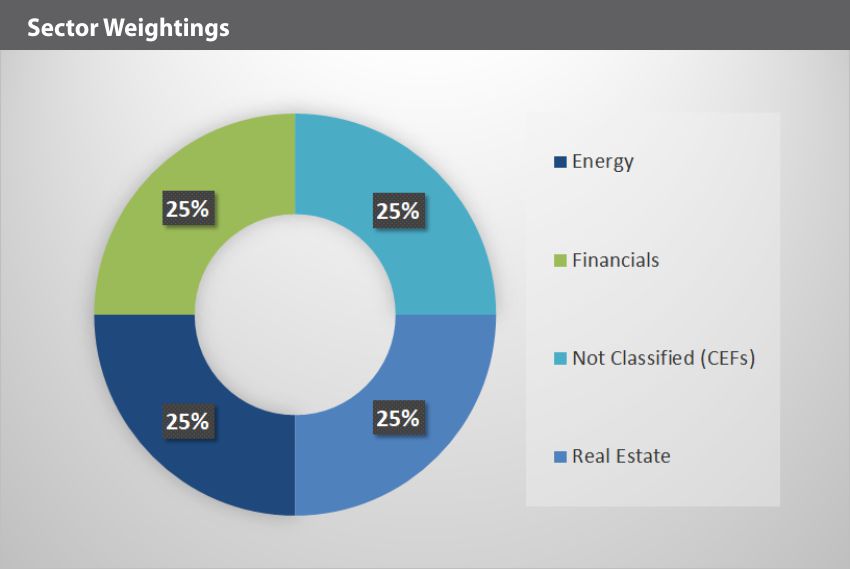

As of 9/30/23

As of 9/30/23

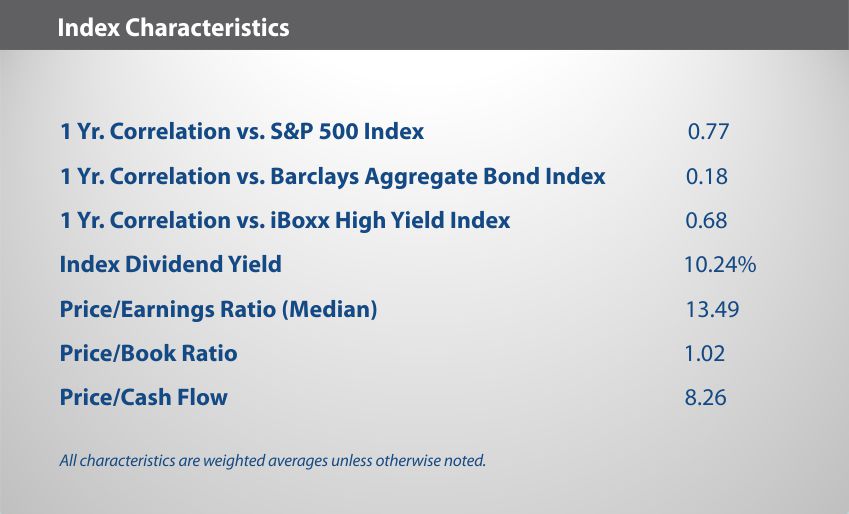

HIGH INCOME PASS-THROUGH SECURITIES INDEX CHARACTERISTICS

As of 9/30/23

As of 9/30/23