Photo: Adobe

EQM Indexes’ Online Retail Holiday Shopping Predictions

We have been looking at our holiday shopping research list, checking it twice, and think that there are some upside surprises in store in online retail that could make the season quite nice!

Looking back at last holiday season, most of the globe was in the midst of a pandemic surge, which, along with continued supply chain issues, helped place a big lump of coal in the stocking of in-person shopping. In 2021, global online shopping stood at record levels, with overburdened carriers barely able to keep up with the demand.

Many online retailers ramped up spending on inventory, infrastructure, and hiring, only to be faced with a post-pandemic growth slowdown. Coming off peak pandemic levels, online retail growth slowed to 7.3% in the second quarter of 2022.

While COVID is less of a concern this holiday season, consumers and retailers are facing new financial headwinds such as price inflation, high fuel costs, and economic uncertainty. The situation is particularly dire in Europe due to fallout from the Russia-Ukraine war. European consumers have more to worry about than their holiday shopping list, such as heating their homes for the winter.

But if the pandemic has taught us anything, it is how resilient the consumer is, regardless of the circumstances.

Here are our key predictions for the holiday shopping season. We believe investors are underestimating the prospects for online retailers this holiday season, which may provide significant upside opportunity.

1. Limited Return to Brick-and-Mortar – Brick-and-Mortar will certainly make a strong comeback as compared to last year as pandemic concerns fade, but post-pandemic shopping habits have been permanently transformed both in-store and online. While shoppers may venture to stores to see and handle products, many of those final purchases will occur online.

2. E-Commerce Sales Growth Will Outpace Brick-and Mortar This Holiday Season – As inflation causes consumers to be pickier about where and how they spend, shoppers will once again embrace the better selection, price comparisons, and convenience of online shopping this holiday season. Higher fuel costs will also discourage aimless driving around and lead to seeking advice online.

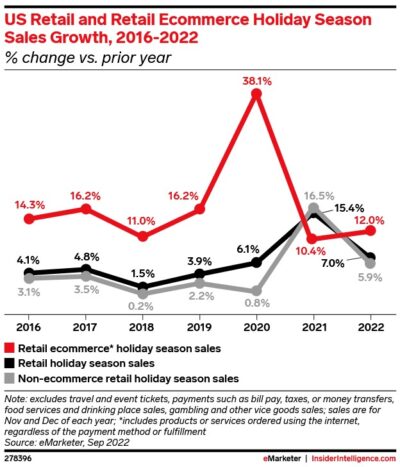

3. US Online Retail Sales Will Surpass Last Year’s Record Levels, Growing 12% – eMarketer|Business Intelligence projects U.S. online holiday sales will surpass last year’s record level, and grow 12% this holiday season. Deloitte also forecasts e-commerce sales will grow by 12.8% to 14.3%, year-over-year, during the 2022-2023 holiday season, suggesting e-commerce holiday sales will land between $260 billion and $264 billion.

eMarketer

4. Holiday Shopping Season Kicks Off Early – Amazon set the tone with its successful Prime Early Access sale in October, which generated $8 billion in gross merchandise value. Shoppers are expected to shop early to find discounts before prices rise and to avoid supply concerns, and retailers are responding, with two-thirds starting their holiday marketing campaigns in October.

5. The Holidays are Back, Regardless – Heading into the holidays, in addition to inflation, consumers are weathering higher interest rates and steep declines in the financial markets. But even without the stimulus payments from previous years not in the mix, after nearly three years of suppressed behavior, consumers are primed to go all out and are ready to spend this holiday season. 80% of U.S. adults plan to spend the same or more than last year and over 70% are willing to explore financing options if necessary. Amazon just added a Venmo payment option at checkout.

6. Consumers Looking for Value – Given economic uncertainty, consumers are being more careful about how they spend, favoring the ability to price shop and solicit expert product advice online.

7. Technology Favors Online Retail – While the in-store experience may be fraught with long lines, limited inventory, and temporary help, the online shopping experience has been enhanced by digital capabilities such as personalization, virtual try-on options, Buy Online, Pickup In-Store (BOPIS), social commerce and livestreaming, and Buy Now Pay Later (BNPL) flexible payment options for cash-strapped consumers. And for online retailers, technology can help drive sales, proactively targeting consumers using artificial intelligence (AI). Mobile ads, in-app rewards, and gaming apps are key ways for retailers and brands to connect with shoppers.

8. Eurozone Consumer Constrained – Russia’s cutbacks in supplies of natural gas have sent energy prices soaring, which is bad news for consumers with winter coming. UK holiday spending is expected to be 22% less than last year, according to Retail Economics, amid inflation rates above 13%. Eurozone inflation also accelerated to 9.9% in September, painting a bleak outlook for retail sales in Europe this holiday season. The situation does create opportunities for retailers who can successfully communicate value to consumers such as discounters like Pepco and Flying Tiger Copenhagen. Off-price and online are expected to be the winners in the battle for holiday consumer in Europe.

Who Will Be the Online Retail Winners This Holiday Season?

• Online Commerce Software – Shopify’s big earnings beat is a wake-up call to how the retail landscape has been permanently transformed by the pandemic. Companies like Shopify, BigCommerce, and Vtex are helping online retailers increase business by adding more sales channels such as social commerce and offering more tools for payment and fulfillment. In addition, an online presence has become essential for all retailers, even those offline.

• Online Travel & Entertainment – There continues to be pent-up demand for both personal and business travel and entertainment, and cost-conscious consumers will use online travel booking tools to find the best deals. Instead of in-person shopping, people are going places and doing things.

• Beauty and Apparel – Consumers remain willing to spend on their appearance and self-care or little luxuries like lipstick and lotion. Apparel also leads the way as more than 50% of consumers in the US and the UK plan to buy fashion/ apparel online this holiday season. Used and vintage good merchandise could also be a popular consumer option this season to help stretch holiday dollars to afford popular brands.

• Mobile App-Enabled Commerce – Mobile phone and gaming apps will be a key way for retailers and brands to connect with shoppers this holiday season. Close to two-thirds of consumers said they plan to use their mobile phone or tablets to shop over the holidays. Increasingly, Gen Z, Millennial, and Gen X consumers are receptive to in-app purchases, mobile ads, and rewarded ads on gaming sites.

References

COVEO. (2022). 2022 Holiday Shopping Report – Spending Trends and Impact.

Grill-Goodman, J. (September 19, 2022). Holiday Retail Forecasts and Predicitions for 2022. Retail Info Systems.

eMarketer|Insider Intelligence. (October 25, 2022). Retail & Ecommerce Briefing.

McKinsey & Company. (October 2022). US holiday shopping 2022: ‘Tis the season to be (cautiously) optimistic.

Morgan Stanley Research Global Insight. (April 20, 2022). Global eCommerce – Stronger for Longer in Global eCommerce.

Morris, T. W. (October 27, 2022). Over 70% of shoppers consider holiday financing as inflation bites: report. Retail Dive. Retrieved from https://www.retaildive.com/news/shoppers-want-financing-for-holiday-purchases-report/635124/

Verdon, J. (October 27, 2022). Mobile Shopping Could Be Santa’s Special Helper This Year. Forbes. Retrieved from https://www.forbes.com/sites/joanverdon/2022/10/27/mobile-shopping-could-be-santas-special-helper-this-year/?sh=6dfae37a1972

Young, J. (October 24, 2022). Online holiday sales to grow 6.1% in 2022, DC360 projects. Digital Commerce 360. Retrieved from https://www.digitalcommerce360.com/article/online-holiday-sales/

ABOUT EQM Indexes

EQM Indexes, LLC (”EQM Indexes”) is a woman-owned firm dedicated to creating and supporting indexes that track growth industries and emerging investment themes. Co-founded by Jane Edmondson, a former Institutional Portfolio Manager with more than 30 years of investment industry experience, EQM Indexes’ index designs span a wide range of asset classes and financial instruments. EQM Indexes does not provide investment advice, nor offer the sale of securities, but does partner and receive compensation in connection with licensing its indices to third parties to serve as benchmarks for Exchange Traded Products (”ETPs”).

DISCLAIMER

All information provided by EQM Indexes is impersonal and not tailored to the needs of any person, entity or group of persons. It is not possible to invest directly in an index. EQM Indexes makes no assurance that investment products based on the index will accurately track index performance or provide positive investment returns. The inclusion of a security within an index is not a recommendation by EQM Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. While EQM Indexes has obtained information from sources believed to be reliable, EQM Indexes does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.