Market Commentary — March 8, 2021

It was another roller-coaster week on Wall Street, as longer-term interest rates continued to climb. The rise in rates weighed the hardest on growth stocks increasing the discount on their future earnings, while value names managed to post gains.

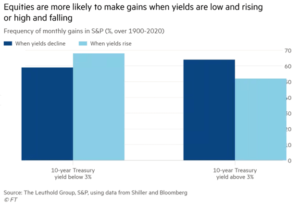

But are rising rates from low levels really such a terrible thing? Here is a great study shared by my colleague Mike Venuto, suggesting equities are likely to gain when yields are low and rising.

Energy stocks rallied last week as oil prices hit their highest level in over a year thanks to recovering economic activity. On a side note, I actually filled my tank this week.

Fed Chair’s mid-week comments failed to soothe investors’ inflation fears, but the positive jobs report on Friday, with non-farm payrolls rising by 379k, twice the consensus estimates, fueled a market rally heading into the weekend. Nearly all those gains were in hospitality. Stocks on Friday vacillated digesting that news, rising, falling, and then rising sharply again.

In ETF land, energy ETFs, including MLPs, was last week’s best performers. The new VanEck Vectors Social Sentiment BUZZ ETF, backed by celebrity spokesperson Dave Portnoy, took in a whopping $280 million inflows its first week. The fund itself was actually down in performance terms. Interestingly, this concept debuted before in 2016 as the Sprott BUZZ Social Media Insights ETF, only to close in 2019. But thanks to the Reddit-trading revolution, it has been successfully resurrected. In ETFs as in life, timing is everything!

Jane Edmondson

CEO and Co-Founder

Share this Market Commentary

About

EQM Indexes LLC is a woman-owned firm dedicated to creating and supporting innovative indexes that track growth industries and emerging investment themes. Co-founded by Jane Edmondson, a former Institutional Portfolio Manager with more than 25 years in the investment industry.

Disclosure

The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of particular time and subject to change at any time without notice.

It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. EQM Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. EQM Indexes Indices makes no assurance that investment products based on the Index will accurately track index performance or provide positive investment returns. EQM Indexes is not an investment advisor, and makes no representation regarding the advisability of investing in any such investment fund or other investment vehicle. A decision to invest in any such investment fund or other investment vehicle should not be made in reliance on any of the statements set forth in this article. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by EQM Indexes to buy, sell, or hold such security, nor is it considered to be investment advice.