Capitalizing On Brand Rotation

My new favorite brand is Lululemon (LULU). I am celebrating the fact that I am finally “fit” enough to “fit” into their yoga pants. Lululemon is a great example of an aspirational brand. People are willing to pay more to wear this upscale brand of clothing and, as a result, the company’s adjusted gross profit margins are a lofty 57.3% on $3.3 billion in annual revenue.

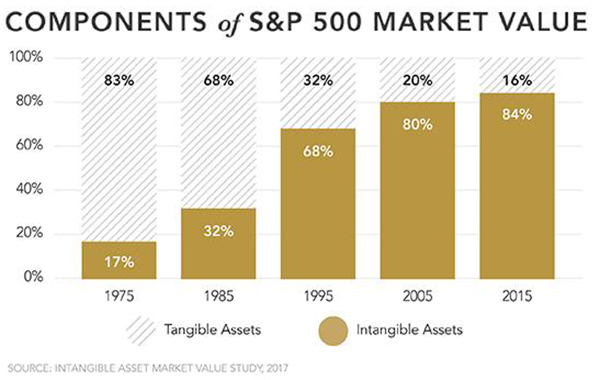

Brand value is an intangible asset that does not show up on the balance sheet, but it does translate into pricing power, profit margins, and strong sales. It is no wonder then, that owning a basket of the top 50 brands yields superior investment results, beating most major indices over the last 10-year time period.

About

EQM Indexes LLC is a woman-owned firm dedicated to creating and supporting innovative indexes that track growth industries and emerging investment themes. Co-founded by Jane Edmondson, a former Institutional Portfolio Manager with more than 25 years in the investment industry.

Disclosure

The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of particular time and subject to change at any time without notice.

It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. EQM Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. EQM Indexes Indices makes no assurance that investment products based on the Index will accurately track index performance or provide positive investment returns. EQM Indexes is not an investment advisor, and makes no representation regarding the advisability of investing in any such investment fund or other investment vehicle. A decision to invest in any such investment fund or other investment vehicle should not be made in reliance on any of the statements set forth in this article. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by EQM Indexes to buy, sell, or hold such security, nor is it considered to be investment advice.